sweetgreen vs. everybody else?

Will the existence of an ESG report entice you to choose one lunch spot over another?

It’s report release season, so let’s hope the day I publish this is not the day that sweetgreen (their spelling) releases the 2023 report.

I also have been tempted to write about big, sprawling companies like Google and IBM — but I think those will take some more research time, perhaps bits and pieces over a few months.

So instead, I am defaulting to one of my favorite topics. Food. Probably more specifically, food that defines the sort of coastal elite world that surrounds me in the NYC suburbs. What screams more coastal elite than a sweetgreen salad between client calls?

More realistically for me, that salad is eaten on a Sunday when I can’t be bothered to do one more chore.

Who can compete with sweetgreen? A $16+ salad prepped from an expansive array of freshly cooked ingredients. Cava, I considered. Or Just Salad, maybe Chopt?

The reason I’m calling this “sweetgreen vs. everybody else?” is because not one other quick lunch spot has a current ESG report. I briefly considered Chipotle, but unlike sweetgreen, you can find Chipotle in towns across the country, whereas many of these salad lunch spots cater to a very specific crowd.

The 2022 sweetgreen Impact Report

sweetgreen has a small presence within the U.S., and as of 2022, there are 186 restaurants across 17 states. But since its founding, it has been committed to sustainable food options, from packaging to farming partnerships.

Aside from a few menu staples like the fan favorite Harvest Bowl, sweetgreen updates menu offerings to focus on seasonal ingredients while highlighting what they call a “win-win-win” strategy of encouraging team members to think sustainably and to create lasting value for customers and the community.

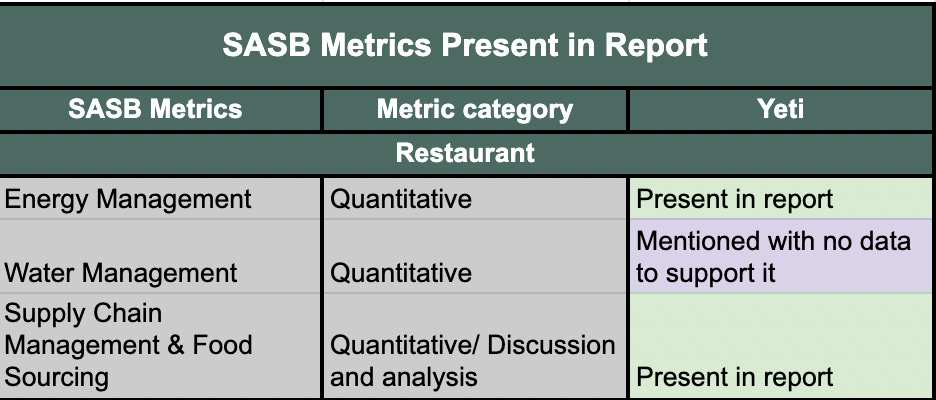

Interestingly, sweetgreen is publicly traded, so they follow the restaurant industry's GRI and SASB standards.

What stood out:

sweetgreen starts its report with the Materiality Metrics — the metrics that help a company match the ESG topics to metrics important to company stakeholders.

Sustainable agriculture, rural livelihood, local sourcing, and animal welfare are right at the top — though, evidently, not using antibiotics might need to be reevaluated when considering animal welfare. For now, organic food within the U.S. cannot be sourced from animals that have been treated with antibiotics.

sweetgreen Impact Report - Materiality Metrics

sweetgreen began tracking and monitoring its emissions in 2019 using Watershed to tabulate and track the data — this is important to note because sweetgreen was first opened in 2007, so that is a relatively young company to start tracking emissions data, and it was before they went public in 2021.

sweetgreen is committed to being carbon neutral by 2027, which would mean that even the emissions from suppliers would need to be eliminated or offset.

In 2021, sweetgreen began purchasing 100% of its energy from renewable sources — but this only offsets Scope 2 emissions from store location electricity consumption.

The charts within the carbon footprint section do a great job at quickly explaining the context within them, like succinctly highlighting what Scope 1, 2, and 3 means.

sweetgreen does provide compost and recycling options in their restaurants and offers biodegradable utensils and compostable containers made from paper, cornstarch, and sugarcane.

What could be improved:

It notes that 48 suppliers completed their carbon footprint assessments, but it does not list the total number of suppliers that supply sweetgreen stores.

64 suppliers were designated as Valued Suppliers, but again we do not know out of how many, and the metrics to meet the Valued Supplier designation are not fully laid out.

From 2021 to 2022, sweetgreen’s Scope 1 emissions increased due to natural gas and refrigerant use within new stores.

Everyone else

In trying to find a company to compare to sweetgreen, I tried to look for ESG reports from Cava, Just Salad, and Chopt.

They all have sustainability sections on their websites, but no current ESG reports, and except for Cava, all of them are privately held. So maybe Cava will be the one to watch in the future as ESG reports are becoming more mainstream.

The Sustainability sections:

The difference between highlighting sustainability goals on a website rather than within an ESG report is that the website can be changed without an archive of traceable data points. Though I suppose an ESG report can be deleted from a website…

Because of this, the sustainability sections within these websites look great on paper, but we cannot be sure how accurate they are.

Cava

And if Cava is the one to watch, then they have a long way to go.

There is not much here at all, it seems like the things that are called out, i.e. their organic chickpeas and Fair Trade-certified sugar are items that just happen to exist as more sustainable, not products they actively sought out.

“We use clean-label-friendly ingredients.” This phrase means absolutely nothing.

Chopt

Chopt has compostable containers and has no single-use plastics in stores.

Includes lofty goals to decrease GHG emissions, but these do not drill down into how the company will achieve the goals. In the image below, the bottom row is especially “greenwashy."

“With a menu that is 75% plant-based, we already reduce our carbon output compared to traditional restaurants by 30%.” This is another sentence that is ill-defined and likely not accurate.

Just Salad

I could not find a more recent impact report than the one published in 2022 for the year 2021, so I chose not to compare this to the sweetgreen report.

But, Just Salad does have some great highlights. They are B Corp certified, they work with PlanetFWD to determine their carbon footprint, and in many stores, you can bring in a reusable plastic container for use — of all of the restaurants, Just Salad was the most sustainability forward.

If I am wrong and the 2022 report exists, send it my way!

It is tough, the existence of an ESG report does not necessarily mean that a company is more eco-friendly than another. What an ESG report does offer is that stated goals and progress, or lack thereof, can be accounted for year over year.

I am a bit surprised that Cava does not dive more deeply into sustainability, especially since they are a public company. But sustainability was never in their brand.

On the other hand, sweetgreen has always promoted climate-friendly food and has worked that into their salads, offering organic options and biodegradable packaging. So it makes sense that they prioritize an ESG report.

So, where should you get lunch?

Wherever you want. You won’t find me judging food choices, just as I expect no one to judge me for paying close to $20 for a salad.

This newsletter is shorter than many of my past ones because it is lacking a random topic rant — this was a busy month for me with less time to delve deeply into a new topic, like a B Corp overview or a CSRD explainer.

I’m curious, is shorter better?

I am also cheating a bit since clearly today is not the last Friday of the month, the day I should send this out. So, you might end up with two May newsletters!

Ana